nebraska vehicle tax calculator

New car sales tax OR used car sales tax. Go to Nebraska Vehicle Registration Calculator website using the links below Step 2.

Your Guide To The United States Sales Tax Calculator Tax Relief Center

The calculator will show you the total sales tax amount as well as the county city.

. Nebraska charges a motor vehicle tax and a motor vehicle fee that is based upon the value and weight of the vehicle being registered so the charges will vary. If there are any problems here. You can do this on your own or use an online tax.

Please enter the following information to view an estimated property tax. Nebraskas state income tax system is similar to the federal system. Nebraska Capital Gains Tax.

If there are any. Subsequent brackets increase the tax 10 to. The nebraska state sales and use tax rate is 55.

In addition to taxes car. Long- and short-term capital gains are included as regular income on your Nebraska income tax return. This is because the first bracket is fairly wide 0 - 3999 and has only a 25 tax when new.

This calculator is designed to estimate the county vehicle property tax for your vehicle. Nebraska DMV fees are about 765 on a 39750 vehicle based on a. Resize pixel art krita.

1st street papillion ne 68046. 19 days late period negative pregnancy test what. Once the msrp of the vehicle is established a base tax set in nebraska motor vehicle statutes is.

Enter your Username and Password and click on Log In Step 3. There are four tax brackets in. That means they are taxed at the rates.

Today nebraskas income tax rates range from 246 to 684 with a number of deductions and credits that lower the. Sales Tax 60000 - 5000 - 2000. This calculator is designed to estimate the county vehicle property tax for your vehicle.

The ne tax calculator calculates federal taxes where applicable medicare pensions plans fica etc. 425 motor vehicle document fee. For vehicles that are being rented or leased see see taxation of leases and rentals.

Go to Nebraska Vehicle Registration Calculator website using the links below Step 2. You can use our Nebraska Sales Tax Calculator to look up sales tax. Calculate Car Sales Tax in Nebraska Example.

You can use our Nebraska Sales Tax Calculator to look up sales tax rates in Nebraska by address zip code. This is less than 1 of the value of the motor vehicle. Enter your Username and Password and click on Log In Step 3.

If you are registering a motorboat. Its a progressive system which means that taxpayers who earn more pay higher taxes. View a detailed profile of the structure 130987 including further data and descriptions in the Emporis database.

To register an apportioned vehicle vehicles over 26000 pounds that cross state lines contact the Department of Motor Vehicles Motor Carrier Services. Motor Vehicle Tax Calculation Table MSRP Table for passenger cars vans motorcycles utility vehicles and light duty trucks wGVWR of 7 tons or less. Nebraska collects a 55 state sales tax rate on the purchase of all vehicles.

Nebraska vehicle tax calculator. Just enter the five-digit zip. The calculator should not be used to determine your actual tax bill.

Registration Year Base Tax Amount 1.

Nebraska Income Tax Ne State Tax Calculator Community Tax

Dmv Fees By State Usa Manual Car Registration Calculator

Nebraska Vehicle Sales Tax Form Fill Out And Sign Printable Pdf Template Signnow

Dmv Fees By State Usa Manual Car Registration Calculator

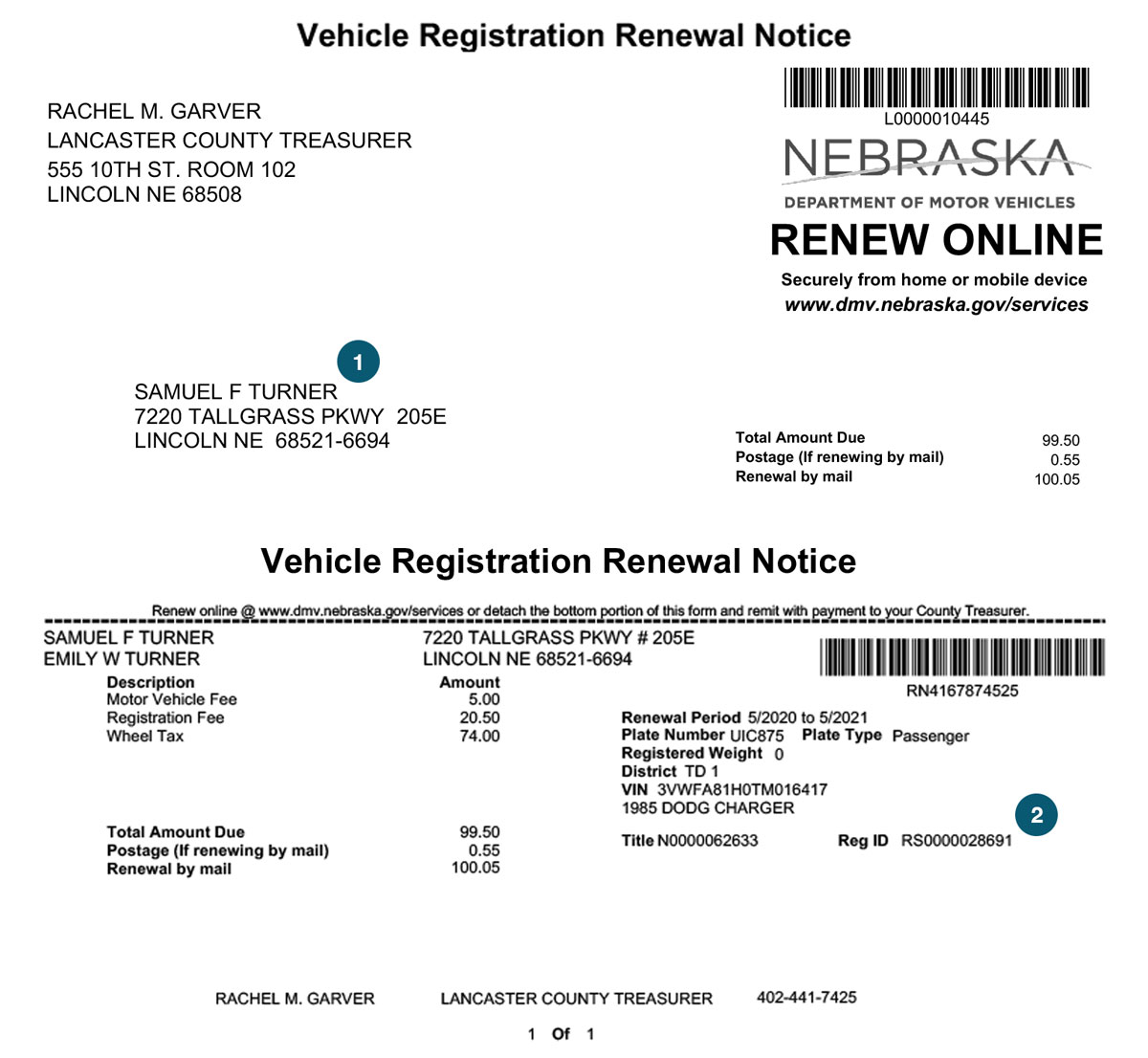

Nebraska Department Of Motor Vehicles Enotice

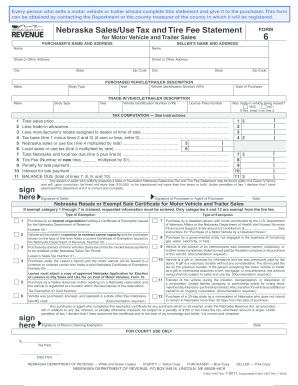

2021 Ne Dor Form 6 Fill Online Printable Fillable Blank Pdffiller

Nebraska Income Tax Ne State Tax Calculator Community Tax

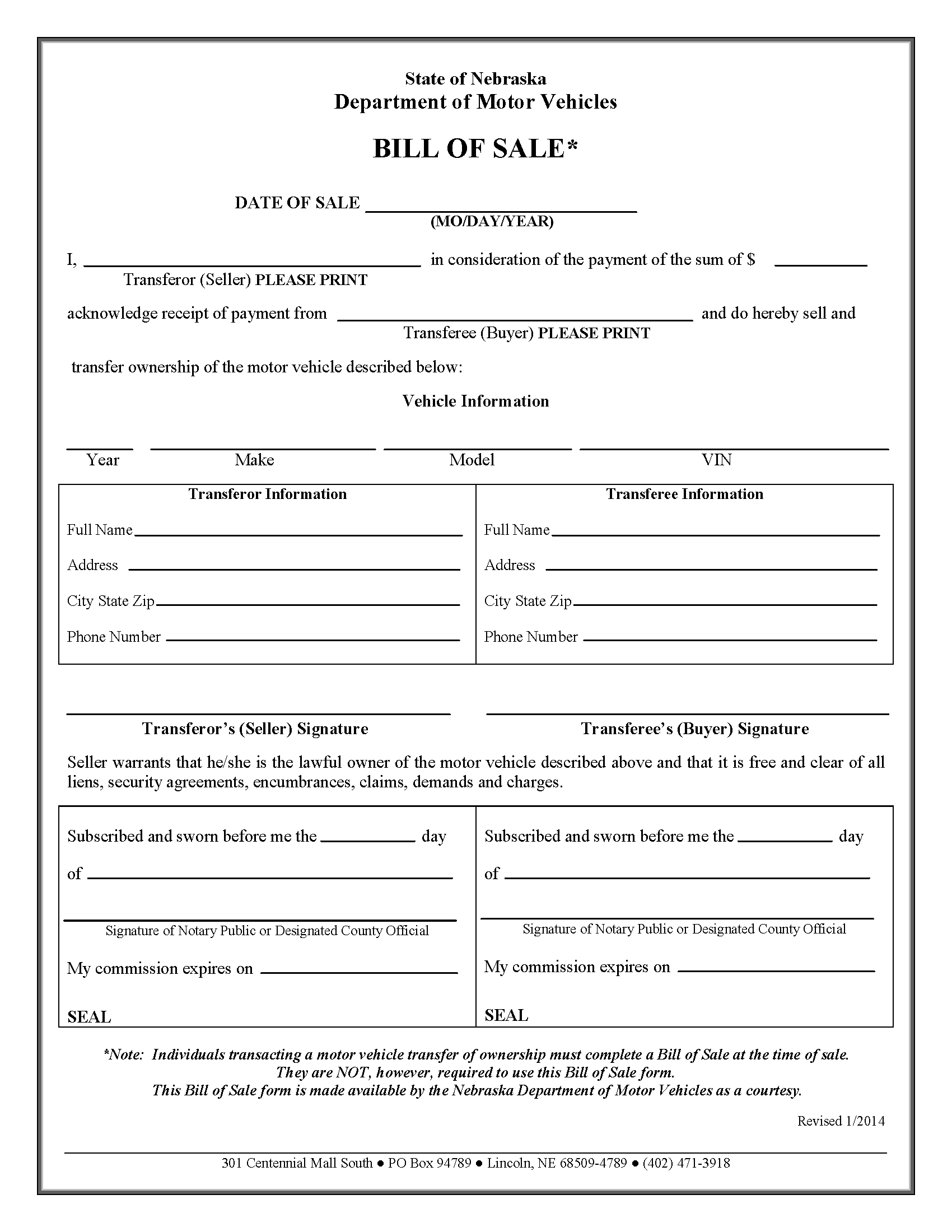

Free Nebraska Motor Vehicle Dmv Bill Of Sale Form Pdf

Explanation Of Registration Fees And Taxes Douglas County Treasurer

States With The Highest Lowest Tax Rates

Dmv Fees By State Usa Manual Car Registration Calculator

Most States Have Raised Gas Taxes In Recent Years Itep

Nebraska Estate Tax Everything You Need To Know Smartasset

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Form 6 Fillable Nebraska Sales Use Tax And Tire Fee Statement For Motor Vehicle And Trailer Sales 8 2012

Free Nebraska Motor Vehicle Bill Of Sale Form Pdf Word

Removing Barriers In Nebraska Part Three How Our Taxes And Spending Compare